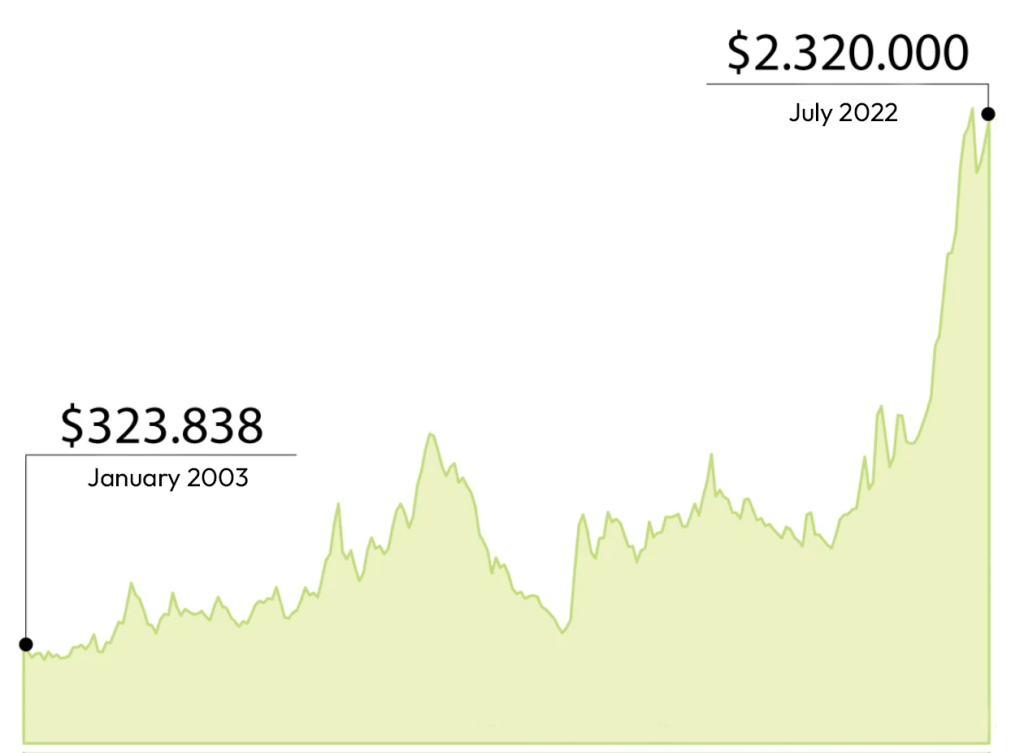

In 2021 and 2022, when we spoke about coffee prices, it was usually to say that it was the highest in history. Month after month, the historical price record was broken, until it reached its peak in July 2022.

Large corporations were forced to increase their coffee prices to consumers for the first time in years. With the worldwide inflation and rapid rise in production and living costs, these high coffee prices didn’t mean that farmers were getting rich. But for the first time in decades – you can see the comparison with the price in 2003 –, they got a fair pay for their product.

The situation in 2023 has been very different. As often happens with commodities, a rapid rise in prices is usually followed by a rapid decline. The logic behind these prices is based on supply and demand, future prognostics, and speculation. It does not have to do with the costs of production of the good. This is manageable for multinational corporations, but not so much for small-scale coffee producers.

In the past months, the price per Carga (125kg) in Colombia has been in freefall. In January 2023, it dropped to $1.838.000. In June, it got to $1.577.000 and in July it reached $1.318.000 – a 40% drop within a year. But why is this happening?

> The global trend of lower commodity prices affects coffee;

> The fluctuation of the Colombian Peso (COP) exchange rate with the US Dollar (USD), because the coffee trade happens in USD but farmers are paid in COP;

> The prognostics for a large harvest in Brazil next year, which makes the market optimistic about an excess in supply;

All of this results in coffee farmers selling their product at a loss – the sales price does not cover the production costs. But since they have no alternative, they have to sell it and hope for better prices next time.

So what is the solution?

While the Colombian Coffee Federation is demanding support from the government, we believe that a solution is only possible with a systemic change. With our monthly incomes for farmers, we maintain a fair price per Carga that considers the costs of production and a livable income for the families.

Besides that, the education project Jardín Municipio Lector, supported by the coffee sales, promotes cultural offerings such as theater classes and reading clubs, as well as a close exchange with the farming families, teaching them about the history and global context of coffee to expand their horizons.

As coffee prices go down, should the price for consumers also go down?

According to the president of Lavazza, an industry giant, the company can foresee reductions in price to the end consumers in 2024, following the lower commodity coffee prices in 2023.

At first, this sounds like a positive thing: instead of keeping that margin as a profit, the company will reduce prices. But if a lower price for the end consumer means that producers are not receiving enough to cover their costs, we don’t consider that to be ethical. Consumers in Europe stand in a privileged position, and saving a few cents on coffee at the cost of the economic stability of farming families is something that we don’t agree with.

As we establish our prices in COP, to be consistent with the living costs in Colombia, that means that a valued COP increases our costs.

Conventional coffee trade with prices in USD (example scenario):

Exchange rate | Nov 2022 | Aug 2023 |

USD | 2,79 USD/pound | 2,79 USD/pound |

COP | 14.139 COP/pound | 11.352 COP/pound |

Even if the USD price stays the same, the price in COP would be almost 20% lower just because of the exchange rate variation.

In our system, we fix the price in COP, according to the living costs in Colombia. So the exchange rate variation affects us differently (example scenario):

Exchange rate | Nov 2022 | Aug 2023 |

COP | 14.139 COP/pound | 14.139 COP/pound |

USD | 2,79 USD/pound | 3,47 USD/pound |

In order to keep a fair income for the farmers, we need to pay more for the coffee in USD. The COP-USD exchange rate tends to have fluctuations, so in order to promote economic stability for the farmers, we take these fluctuations into our side of the business.

In real numbers, this is the comparison of our price per Carga from January and August:

Exchange rate | Jan 2023 | Aug 2023 |

COP | 2.251.724 COP/Carga | 2.251.724 COP/Carga |

USD | 469,01 USD/Carga | 558,98 USD/Carga |

This means an increase of over 19% on our coffee price in USD (and consequently in EUR) due to the exchange rate fluctuation.

For our customers, this means that we will adjust our prices again. As a reward to our Genossenschaft members, we will maintain the same prices we currently have, and only increase prices for non-members. If you’re not a member yet, this is a good moment to become one. Click here to find out how.

Thanks for reading!